Venture Capital and Corporate Social Responsibility

Beyond monetary rewards, venture capital has other benefits. As it embraces social responsibility, it promotes change for a better future. Venture capitalists promote innovation and help to create a better society via impact investing, environmentally friendly supply chains, diversity, health advancements, and moral business conduct. They have a long-lasting effect through promoting sustainability and CSR.

In a rapidly changing world, sustainability isn't just an option—it's a pressing necessity. The same rings true across all domains, including the exciting world of venture capital. It begs the question: Can present financial profit alone ensure enduring efficiency and success? The answer lies in a more nuanced perspective—one that considers the longevity of returns and the societal impact of invested industries. Let’s explore how venture capital embraces social responsibility, driving positive change for a better future.

Understanding Venture Capital

What is it?

A type of financing that involves investors providing funds to start-ups and emerging companies with high growth potential.

Venture capitalists take calculated risks in exchange for owning a portion of the company.

Goal

To support these early-stage businesses, fuel innovation, and help them achieve rapid growth by providing not only financial resources but also mentorship and expertise.

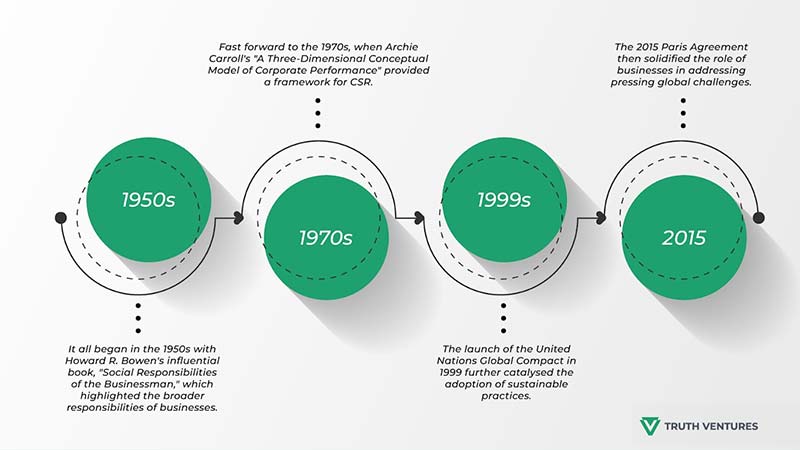

The Emergence of Corporate Social Responsibility

These milestones have paved the way for CSR to become an integral part of the modern business landscape, emphasising the importance of social and environmental impact alongside financial success.

How Venture Capital Firms Promote Corporate Social Responsibility

Impact Investing: Venture capitalists have actively supported and seed funding for startups focused on social and environmental impact. For instance, investors like Acumen have invested in ventures like d.light, which provides affordable solar energy solutions to underserved communities, improving access to clean and sustainable energy.

Sustainable Supply Chain: Blockchain technology offers transparent and traceable supply chains, enabling companies to verify the ethical sourcing and sustainability of their products. Venture capital like Truth Ventures invests in blockchain start-ups that provide solutions for supply chain transparency, helping businesses ensure responsible sourcing practices.

Diversity and Inclusion: VC firms have prioritised diversity and inclusion by investing in companies that promote gender and racial equality. For example, Backstage Capital, led by Arlan Hamilton, invests in underrepresented founders, aiming to address the diversity gap in the start-up ecosystem.

Digital Health Innovations: Venture capitalist companies like Truth Ventures invest in healthcare and holistic wellness start-ups that leverage technology to improve healthcare accessibility, affordability, and outcomes. These include telemedicine platforms, remote patient monitoring, personalised health apps, and electronic health records. Their support contributes to advancing healthcare, promoting social responsibility, and enhancing access and efficiency.

Environmental Sustainability: VCs have backed numerous clean technology and renewable energy companies. Kleiner Perkins, a prominent venture capital firm, has invested in companies like Tesla and Bloom Energy, driving the transition to a sustainable and low-carbon future.

Social Impact Start-ups: Venture capitalists have supported start-ups addressing critical social issues. For instance, Omidyar Network has invested in organisations like Change.org, a platform empowering individuals to initiate social change through petitions and campaigns.

Diverse and Inclusive Content: VC firms like Truth Ventures invest in entertainment and OTT platforms that prioritise diverse and inclusive content. They support companies that produce content representing different cultures, backgrounds, and perspectives, promoting social responsibility by fostering inclusivity and representation.

Ethical Practices: VCs have encouraged ethical business practices and corporate governance. They have actively supported companies that prioritise transparency, responsible supply chain management, and fair labour practices.

Sustainable Practices: Like Truth Ventures, venture capitalists invest in hospitality businesses that prioritise sustainable practices. This can include implementing energy-efficient technologies, reducing waste, promoting responsible sourcing, and supporting eco-friendly initiatives. By investing in sustainable hospitality ventures, venture capitalists contribute to CSR by reducing environmental impact.

Conclusion

Venture capital and corporate social responsibility go hand in hand, driving positive change and shaping a better future. Venture capital companies like Truth Ventures are not only focused on financial profit but also consider the long-term sustainability and societal impact of their investments. By supporting impact-driven companies, promoting sustainable practices, investing in diversity and inclusion, and backing innovative solutions in healthcare, entertainment, and hospitality, venture capitalists play a vital role in promoting corporate social responsibility. As we move forward, the prospects are promising. With a continued focus on CSR, venture capital has the power to foster innovation, address pressing social and environmental challenges, and create a more sustainable, inclusive and, most of all, profitable world for everyone.

info@truthvent.com

info@truthvent.com